How To Fundamental Analysis Forex

What is fundamental analysis. Fundamental analysis in forex is a type of market analysis which involves studying of the economic situation of countries to trade currencies more effectively.

Fundamental Analysis Learn Forex Fundamental Analysis

Fundamental Analysis Learn Forex Fundamental Analysis

how to fundamental analysis forex

how to fundamental analysis forex is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in how to fundamental analysis forex content depends on the source site. We hope you do not use it for commercial purposes.

Fundamental analysis is a broad term that describes the act of trading based purely on global aspects that influence supply and demand of currencies commodities and equities.

How to fundamental analysis forex. Forex fundamental analysis is a big phrase fundamental analysis encompasses a lot of things. Both beginner and veteran traders can benefit from the material that follows but veterans have learned to make one important distinction. For the rest of us just know these three main parts of forex fundamental analysis.

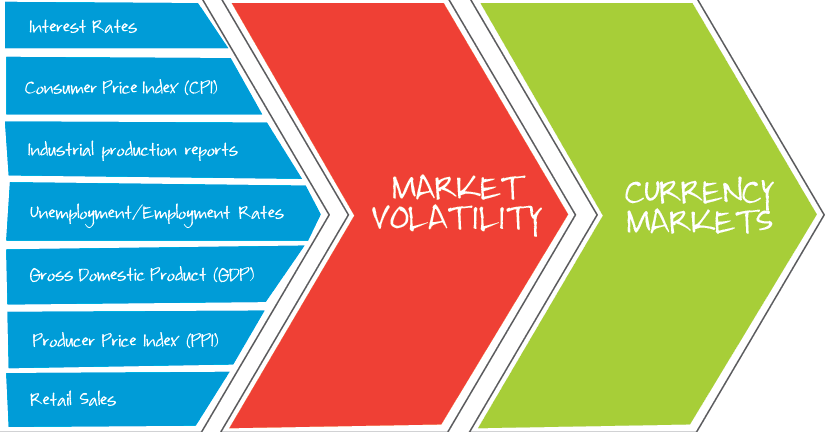

These factors may include for example gdp growth rates potentially disruptive geopolitical events employment statistics interest rates and balance of trade reports among others. Fundamental approach in forex forecasting involves the studying of a countrys economic situation to determine its future currency valuation. Fundamental analysis and technical analysis fa and ta go hand in hand in guiding the forex trader to potential opportunities under ever changing market conditions.

Eliminate the need to analyze the news independently by reading daily fundamental analysis from dailyforex. If you want to get super nerdy with it this page from investopedia is for you. Approaches to fundamental analysis.

Forex and cfd prices are impacted by macro and micro economic data geo political events and their linkages. While the technicality of forecasting can easily be obtained from online websites it is the fundamental analysis forex pdf that is difficult to interpret and utilise the information while trading. It gives information on how the big political and economical events influence currency market.

Since fundamental analysis is about looking at the intrinsic value of an investment its application in forex entails looking at the economic conditions that affect the valuation of a nations. If you think about it this makes a whole lot of sense. Fundamental analysis is a way of looking at the forex market by analyzing economic social and political forces that may affect the supply and demand of an asset.

Our forex fundamental analysis is written by experienced economists who can clearly extrapolate market lessons from daily news events. Many traders think that technical analysis is the best way to trade forex but i like to use technical analysis as a tool to help me refine my entries into the market. Many traders will use both fundamental and technical methods to determine when and where to place trades but they also tend to favor one over the other.

Just like in your economics 101 class it is supply and demand that determines price or in our case the currency exchange rate.

Technical Vs Fundamental Analysis In Forex

Technical Vs Fundamental Analysis In Forex

How To Combine Fundamental And Technical Analysis

How To Combine Fundamental And Technical Analysis

Forex Trading Fundamental Analysis Masterclass Part 1

Forex Trading Fundamental Analysis Masterclass Part 1

How To Use Fundamental Analysis In Forex Trading

How To Use Fundamental Analysis In Forex Trading

Forex Fundamental Analysis Forex Market

Forex Fundamental Analysis Guide

Forex Fundamental Analysis Guide

Forex Fundamental Analysis An Introduction Tradersir

Forex Fundamental Analysis An Introduction Tradersir

Aud Usd Fundamental Analysis Archives Forex Gdp

Aud Usd Fundamental Analysis Archives Forex Gdp

How To Analyse The Forex Market Quora

Forex Trading Fundamental Announcements

Forex Fundamental Analysis An Introduction Tradersir

Forex Fundamental Analysis An Introduction Tradersir